F I Had an Option

Options can be dangerous.

Options can be dangerous.

Why?

They accept a time limit.

That's completely different than how stocks merchandise.

Then if you're going to trade options, you're going to have to master the ins and outs of options expiration.

This guide will answer every unmarried question

Why Options Expiration (OpEx) is And so Important

If y'all come from a directional trading background (meaning long or short), and then you lot probably only focus on where a stock or market place is going.

But that is simply one part of the choice trading equation. Information technology'southward known as delta.

The true risks in the options marketplace come from two things:

Theta - the change of an option price over time

Gamma - your sensitivity to price motility

A failure to empathise these risks mean that you'll put your portfolio in danger... specially as options expiration approaches.

If y'all're in the dark near the true mechanics of options expiration, make sure yous read this earlier you trade another choice.

How Does Options Expiration Work?

When it comes downwards to it, the financial market is all about contracts.

If you buy a stock, information technology's basically a contract that gives y'all role ownership of a company in exchange for a cost.

But options are not well-nigh ownership. Information technology's about the transfer or hazard.

It'south a contract based on transactions.

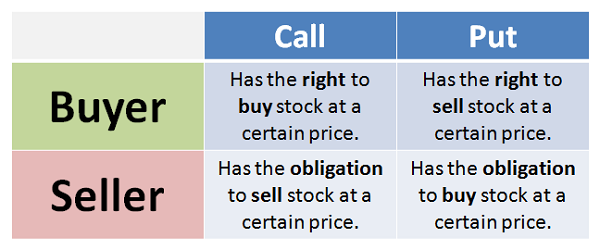

In that location are two kinds of options, a call and a put.

And you have two kinds of participants, buyers and sellers.

That leaves us with four outcomes:

If you're an choice buyer, you can use that contract at any time. This is known as exercising the contract.

If you're an option seller, you have an obligation to transact stock. This is known every bit consignment.

On the third Saturday of the month, if you lot have any options that are in the money, you lot will exist assigned. This process is known as "settlement."

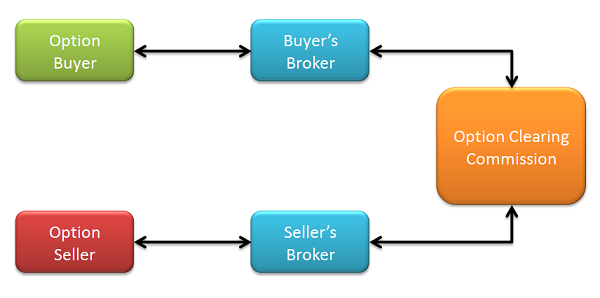

The transaction in these options is handled betwixt you, your broker, and the Options Clearing Corporation. You never will deal straight with the trader on the other side of the option.

If you are long options that are in the money, you lot will automatically brainstorm the settlement process. If you lot don't want this to happen, y'all will have to telephone call your broker.

Why don't Out of the Money Options get assigned?

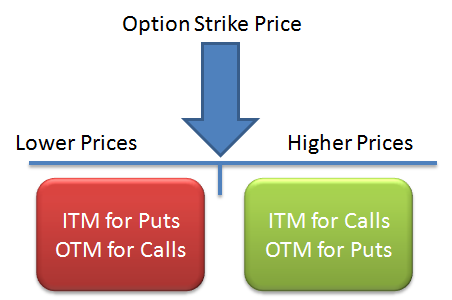

Each option has a cost that the buyer can buy or sell the stock-- this is known as the strike price.

If it is "cheaper" to become the stock on the market, then why would you lot use the option?

If the stock is trading at $79, which makes the nearly sense...

Buying the stock on the market at $79?

Or using the option to buy the stock at $80?

The first i, of course.

So into expiration, these out of the money options will expire worthless.

What are the Options Expiration Dates?

Technically,expiration occurs on Sat. That'southward when settlement actually occurs. But since the market'due south don't really trade on Saturday, we treat Fri as the effective expiration date.

For monthly pick contracts, the expiration is the Third Friday of each month.

With the introduction of weekly options into the mix, nosotros now have options that elapse every unmarried Friday.

The CBOE has a handy calendar that y'all tin can download and print for your desk.

Are There Exceptions?

In that location'due south a handful of "goofy" expiration dates on specific options boards.

For monthly SPX options, they stop trading on Thursday, and the settlement value is based on an opening print Friday morning. These contracts are "cash settled" meaning at that place is no true assignment only instead you wait at the intrinsic value of the options and convert it into cash.

Hither's where information technology can get weird. SPXweekly options are settled on Friday at the close. And then if you are trading around OpEx with the SPX you demand to check if it'south a weekly or monthly contract.

How practise options trade at expiration?

When nosotros await at options pricing, we by and large follow a traditional model. We tin can expect at the things that touch on the options pricing, known as the greeks.

But when the market heads into options expiration, weird things can happen.

Information technology'due south very similar comparing traditional particle physics with what happens at the breakthrough level.

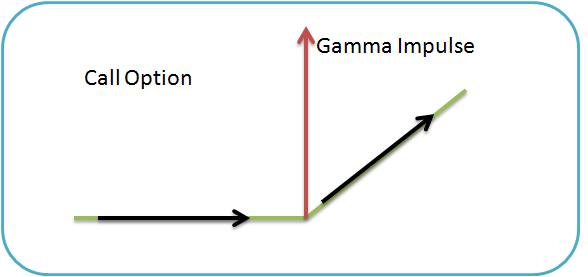

There'south a concept that I call the "gamma impulse."

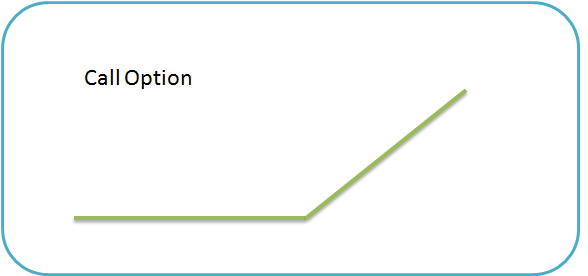

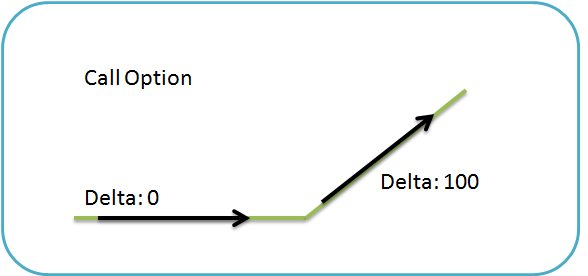

If y'all look at a call option into expiration, it has this risk profile:

Nosotros know that if the choice is out of the money, it will have no directional exposure (0 delta), and if the option is in the coin information technology volition acquit similar stock (100 delta).

The gamma of an choice is the modify of the delta relative to price.

And so there is this discontinuity right at the strike price-- and the gamma of the pick can be represented by a "dirac function." This is what I telephone call a gamma impulse.

If you have an option that switches from OTM to ITM very chop-chop, your risks change drastically.

What if I don't take enough cash to comprehend consignment?

This is where it gets interesting.

And this is why you need to exist extra vigilant into expiration.

If you have a brusque option that goes in the money into expiration, you must fulfill that transaction.

If y'all don't accept enough capital letter, you lot will go a margin phone call on Monday.

Yous also have gap risk.

This happened to me back in 2007.

I had a pretty decent-sized iron condor in BIDU.

This was back earlier their x:1 split.

I found on Saturday that the short options had expired in the money, and that I now had a sizeable long position on in BIDU.

Not Fun.

I was lucky enough to see BIDU gap upward the following Monday and I exited for a gain.

But... never again. Brand sure your books are cleared out of all in the money options if you lot don't want to get assigned.

What if I'thousand short a phone call without stock?

If you have a sold call, y'all will be given a short position if y'all don't own the stock already. This is known as a "naked" phone call rather than a "covered" phone call.

Margin to agree this short is determined by your banker, and to eliminate the short yous volition have to "buy to close" on that stock.

What about options pinning?

See my full guide on options pinning.

Can You Get Assigned Early on?

There are two types of options: American and European.

With European-style options, you can't get assigned early.

With American-style, you lot tin can become assigned whenever the option heir-apparent feels like it.

Well-nigh options are American style, but you rarely accept early assignment.

What if I don't want to get assigned?

So you're coming into options expiration with short options that are in the money.

And you don't want to be brusque the stock or own the stock.

Fair enough.

- Solution #1: Never get downwards to options expiration with in the money options. Exist proactive with your trades.

- Solution #2: Close out the in the money pick completely. This may exist hard into options expiration as the liquidity volition dry up and you lot will be forced to take a worse cost.

- Solution #3: Roll your option out in time or toll. These kinds of rolls, as detailed in my options trading grade, will move your position into a different contract that has more than time value, or is out of the coin. These are known every bit calendar rolls, vertical rolls, and diagonal rolls.

A good rule of thumb is if your option has no extrinsic value (time premium) left, then you need to adapt your position.

How To Make Money Trading Around Expiration

Because of that "gamma impulse" we talked nearly before, the risks and rewards are much, much higher compared to normal options tarding.

There's two groups of OpEx trades to consider: option buying strategies and selection selling strategies.

Option ownership strategies attempt to make money if the underlying stock sees a faster move than what the options are pricing in. The turn a profit technically comes from the delta (directional exposure), but since information technology is a long gamma trade, your directional exposure can alter speedily leading to massive profits in the very brusque term. The main risk here is time decay.

Option selling strategies endeavour to make money if the stock doesn't move effectually that much. Since you are selling options you want to buy them back at a lower price. And since pick premium decays very fast into OpEx, the majority of your profits come from theta gains. Your master gamble is if the stock moves against y'all and your directional exposure blows out.

Options Expiration Trading Strategy Examples

We exercise trade effectually OpEx at IWO Premium. Here are some of the strategies we use:

Weekly Straddle Buys

This is a pure volatility play. If we recall the options market is cheap enough and the stock is fix to move, nosotros will buy weekly straddles.

As an case, a trade alert was sent out to buy the AAPL 517.l straddle for 5.25. If AAPL saw more 5 points of movement in either direction, we'd exist at breakeven. Annihilation more would be turn a profit.

The next day, AAPL moved over 9 points, leading to a profit of over $400 per straddle:

This merchandise is risky because it has the opportunity to go to full loss in less than 5 days. Position sizing and aggressive risk direction is key hither.

Spread Sale Fades

When an private stock goes parabolic or sells off hard, nosotros volition await to fade the trade by either purchasing in-the-money puts or past selling OTM spreads.

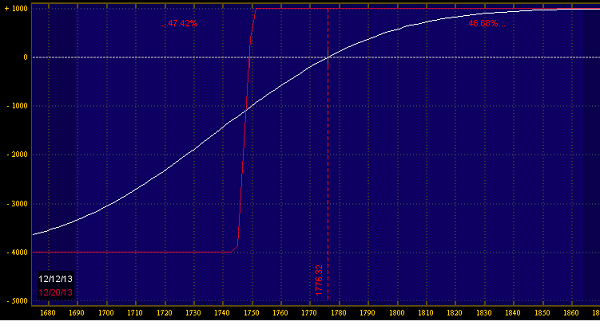

With the market place selling off difficult in Dec and the VIX spiking upwardly, premium in SPX weeklies were high enough to sell them. Then a trade alert was sent out to sell the SPX 1750/1745 put spread for 0.90:

Once the chance came out of the market, nosotros were able to capture full credit on the trade.

Lotto Tickets

These are high-run a risk, high-reward trades that speculate strictly on the direction of a stock. Generally a stock will develop a short term technical setup that looks to resolve itself over the course of hours instead of days. Considering of that short timeframe, we're comfortable with buying weekly calls or puts. These trades are made in the conversation room only, every bit they are fast moving and very risky.

These are just some of the trades we accept within the IWO Premium Framework. If you feel that it'south a correct fit for yous, come check out our trading service.

Source: https://investingwithoptions.com/options-expiration/

0 Response to "F I Had an Option"

Post a Comment